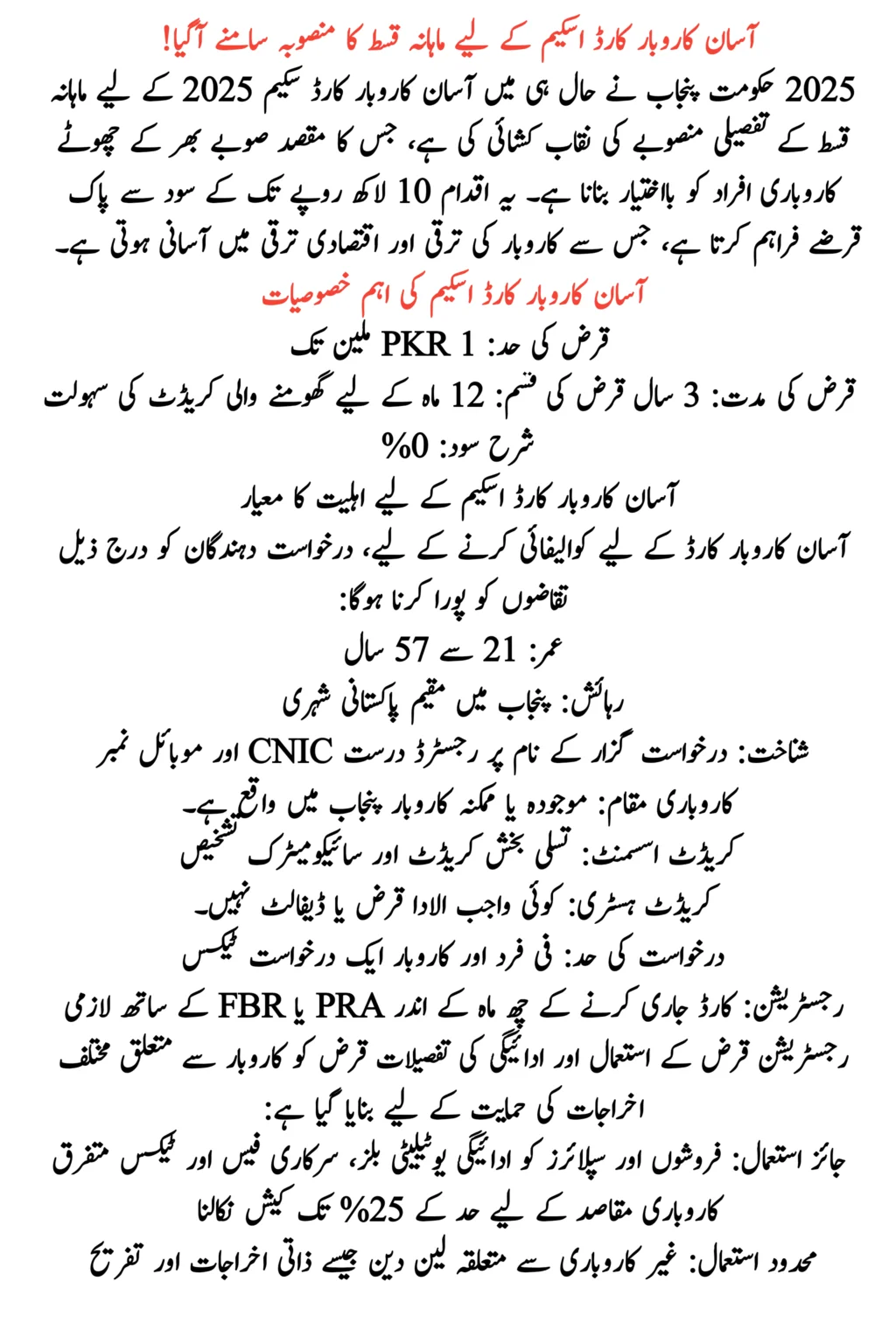

The Punjab Government has officially introduced the installment plan for the Asaan Karobaar Card Scheme 2025, a revolutionary step towards supporting small and medium enterprises (SMEs). This initiative provides interest-free loans of up to PKR 1 million, helping entrepreneurs expand their businesses without financial strain.

Let’s explore the key details, eligibility criteria, and installment plan for this beneficial scheme.

Key Features of the Asaan Karobaar Card Scheme

The Asaan Karobaar Card Scheme 2025 is designed to offer easy access to funds for business expansion. Here are the essential features:

- ✅ Loan Limit: Up to PKR 1 million

- ✅ Loan Duration: 3 years

- ✅ Interest Rate: 0% (Completely Interest-Free)

- ✅ Loan Type: Revolving credit facility (12-month cycle)

- ✅ Grace Period: 3 months before repayment starts

Breakdown of Loan Usage

| Details | Information |

|---|---|

| Application Start Date | January 1, 2025 |

| First Installment Due | April 1, 2025 (After a 3-month grace period) |

| Loan Disbursement | 50% of the approved loan is available initially; the remaining 50% is accessible upon meeting compliance requirements |

| Repayment Plan | Monthly installment of 5% of the utilized amount for the first year; remaining balance repaid over the next 2 years |

| Application Deadline | December 31, 2025 |

| Eligibility Age | 21-57 years |

Who Can Apply? Eligibility Criteria for the Asaan Karobaar Card

To qualify for the Asaan Karobaar Card, applicants must meet the following requirements:

✔ Age: 21 to 57 years

✔ Residency: Must be a Pakistani citizen residing in Punjab

✔ Business Location: Business (existing or planned) must be located in Punjab

✔ CNIC & Mobile Number: Must have a valid CNIC and a registered mobile number

✔ Credit Assessment: Must pass a psychometric and credit evaluation

✔ No Defaults: Applicants should not have any overdue loans or financial defaults

✔ Tax Registration: Must register with PRA (Punjab Revenue Authority) or FBR (Federal Board of Revenue) within six months of receiving the loan

This scheme is aimed at small business owners, startups, and young entrepreneurs who need financial support for business expansion.

Also Read: CM Punjab Announces Phase 2 of E-Bike Scheme: 100,000 Electric Bikes for Students

Monthly Installment Plan for Asaan Karobaar Card 2025

The repayment plan ensures flexibility and affordability, making it easier for businesses to manage cash flows.

Repayment Schedule

📌 Initial Loan Access:

- First 50% of the loan limit is available for use within the first six months.

📌 Grace Period:

- Borrowers do not need to pay anything for the first 3 months after card issuance.

📌 Monthly Installments:

- After the grace period, borrowers need to pay 5% of the used loan amount per month for the first year.

- The remaining balance is paid over the next 2 years in equal monthly installments (EMIs).

📌 Additional Loan Access:

- The remaining 50% of the loan limit is unlocked after timely repayments and registration with PRA or FBR.

Where Can You Use the Loan?

✅ Approved Expenses:

✔ Vendor & supplier payments

✔ Utility bills, government taxes, and fees

✔ Cash withdrawals (up to 25% for business-related expenses)

❌ Restricted Expenses:

✘ Personal expenses (shopping, entertainment, travel, etc.)

✘ Any non-business-related transactions

How to Apply for the Asaan Karobaar Card?

Applying for the Asaan Karobaar Card is a simple process. Here’s how you can do it:

Step-by-Step Application Process

1️⃣ Online Registration:

- Visit the Punjab Information Technology Board (PITB) portal and fill out the online application form.

2️⃣ Processing Fee:

- Pay a non-refundable fee of PKR 500 to process your application.

3️⃣ Verification Process:

- Digital verification of your CNIC, business details, and credit history will be conducted.

4️⃣ Approval & Loan Disbursement:

- If approved, you will receive your Asaan Karobaar Card with an allocated credit limit.

Conclusion

The Asaan Karobaar Card Scheme 2025 is a game-changer for entrepreneurs in Punjab. With interest-free loans, a structured repayment plan, and flexible usage, this initiative aims to boost business growth and economic development. If you are an aspiring entrepreneur, this is your chance to secure funding and scale your business successfully!

Also Read: PM Youth Loan Scheme Expands: Easy Laptop Loans & Financial Aid for Working Abroad

FAQs

1. When is the last date to apply for the Asaan Karobaar Card?

The last date to apply is December 31, 2025. However, it’s recommended to apply early to secure approval.

2. What happens if I don’t repay the monthly installments on time?

Late payments can affect your credit score and may result in penalties. It’s important to follow the repayment plan to maintain eligibility for future funding.

3. Can I withdraw the full loan amount in cash?

No, you can only withdraw up to 25% of your credit limit in cash. The rest should be used for business-related transactions like vendor payments and bills.

4. Is there any collateral required for this loan?

No, the Asaan Karobaar Card offers collateral-free loans, making it accessible to small business owners.

5. How long does it take to get approval after applying?

Approval depends on verification and assessment, but generally, it can take a few weeks for the application to be processed.